Crypto OTC trading platform give an opportunity for HV traders, crypto market makers and institutional investors to trade cryptocurrencies directly with each other, without going through an exchange and without moving the market price. Some platforms even accepts retail traders to execute OTC trade.

Unlike regular exchanges, which execute trades through an orderbook and can affect the market price movement drastically. Crypto OTC trades are conducted directly between two parties in agreement, with the OTC desk acting as a facilitator.

An Overview of OTC Trading in the Cryptocurrency Landscape

Over-The-Counter (OTC) trading in the cryptocurrency world has grown significantly over the past few years. The best OTC crypto exchange platforms offer a unique environment for high volume trades, often favored by large scale investors. OTC crypto brokers, acting as intermediaries, provide a discreet trading environment and facilitate transactions between parties without exposing orders to the public market. Some traders also opt for OTC crypto stocks, which are a way to invest indirectly into the crypto market. The best OTC trading platforms boast features like competitive pricing, deep liquidity, fast settlement, and personalized service.

The meaning of OTC trading in a broader sense is a decentralized form of trading that occurs directly between two parties, without the oversight of exchanges. Some of the largest crypto OTC desks, including Binance OTC and Kraken OTC, offer such services, each with their unique features and benefits. Binance OTC, for example, offers a large selection of cryptocurrencies, while Kraken OTC offers a highly personalized service for high net worth individuals and institutions. Together, these components create a robust and dynamic OTC trading environment in the crypto market.

The prominence of OTC in crypto cannot be understated. As high-volume traders and institutional investors look for ways to execute large trades without causing abrupt market fluctuations, they often turn to OTC crypto exchanges. These platforms, powered by sophisticated OTC exchange software, allow for more discreet and efficient transactions, often providing a more stable price and personalized trading experience compared to standard exchanges. This bespoke approach to trading ensures that large orders don’t immediately show up on public order books, thereby preventing undesirable price spikes or drops.

Want to learn more about Crypto Prop Trading firms? Check our blog here!

Benefits of Crypto OTC Trading

OTC trading has number of benefits over regular exchange-based trading, including:

Privacy

One of the key advantages of over-the-counter trading. OTC trades, unlike regular exchange-based trades, are not recorded on public exchanges and so give traders with greater privacy. This is especially important for institutional investors who may not wish to disclose their trading activities.

Larger Trades

Crypto OTC Trading platforms enable traders to make execute trades without impacting the market price, but large trades on exchanges have the potential to sway the market. This is because the over-the-counter transactions are not completed via an order book, but rather through direct agreements between two parties.

Customized Solutions

Crypto OTC Trading systems enable traders to create customized solutions that meet their individual requirements, including as trade structures, settlement procedures, and reporting formats. This level of customization is not typically provided by standard cryptocurrency exchanges.

How Crypto OTC Trading Operates

Crypto OTC Trading is done by a network of brokers and traders that negotiate transactions directly with one another. The process typically works as follows:

A trader contacts the crypto OTC trading platform and expresses interest in buying or selling a specific amount of a cryptocurrency.

The crypto OTC trading platform matches the trader with a counterparty who is interested in the opposite trade.

The parties negotiate the parameters of the transaction, including the price, amount, and date of settlement.

Once a trade has been agreed with sides, it is executed directly between the parties and is not disclosed on any public exchange.

The crypto OTC trading platform facilitates the arrangement process and aids in fulfilling the commitments of both parties.

Check out : Web3 Startups 2023

20 Crypto OTC Trading Platforms

There are numerous crypto OTC trading desk available nowadays, here are few of the best otc trading platform.

Here is a table of the 20 leading crypto OTC trading platforms.

| Platform | Description | Key Features |

|---|---|---|

| Binance OTC Trading Desk | A platform that allows users to trade large amounts of cryptocurrency without affecting the market price. It offers a wide range of cryptocurrencies, competitive pricing, and fast settlement. | High minimum trade size, limited to accredited investors |

| Genesis Trading | A regulated OTC trading platform that offers a wide range of services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of liquidity. | High minimum trade size, limited to accredited investors |

| ItBit OTC Trading Desk | An OTC trading platform that offers a variety of cryptocurrencies and fiat currencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | High minimum trade size, limited to accredited investors |

| Kraken OTC Desk | A platform that allows users to trade large amounts of cryptocurrency with personalized service and more liquidity. It offers a wide range of cryptocurrencies, competitive pricing, and fast settlement. | High minimum trade size, limited availability |

| OTCBTC | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Not regulated, limited customer support |

| SFOX | A platform that offers a variety of trading services, including OTC trading. It offers competitive pricing, 24/7 trading, and a high level of liquidity. | High minimum trade size, limited to accredited investors |

| Circle OTC | A platform that offers OTC trading services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of security. | High minimum trade size, limited to accredited investors |

| Bitfinex OTC Desk | A platform that allows users to trade large amounts of cryptocurrency with personalized service and more liquidity. It offers a variety of cryptocurrencies, competitive pricing, and fast settlement. | High minimum trade size, limited to accredited investors |

| Houbi OTC | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Not regulated, limited customer support |

| B2C2 | A platform that offers a variety of trading services, including OTC trading. It offers competitive pricing, 24/7 trading, and a high level of liquidity. | High minimum trade size, limited to accredited investors |

| Trigon Trading | A platform that offers OTC trading services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of security. | High minimum trade size, limited to accredited investors |

| Securrency | A platform that offers a variety of trading services, including OTC trading. It offers competitive pricing, 24/7 trading, and a high level of security. | Not regulated, limited customer support |

| Amber Group | A platform that offers OTC trading services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of security. | High minimum trade size, limited to accredited investors |

| DDEX OTC | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Not regulated, limited customer support |

| Bitstamp OTC | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Limited availability |

| LakeBTC | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Not regulated, limited customer support |

| VC Trade | A platform that offers OTC trading services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of security. | High minimum trade size, limited to accredited investors |

| OTC Prime | A platform that offers OTC trading services to institutional investors. It offers competitive pricing, 24/7 trading, and a high level of security. | High minimum trade size, limited to accredited investors |

| The Rock Trading | A platform that allows users to trade a variety of cryptocurrencies. It offers competitive pricing, fast settlement, and a high level of liquidity. | Not regulated, limited customer support |

| LMAX Digital | A platform that offers a variety of trading services, including OTC trading. It offers competitive pricing, 24/7 trading, and a high level of liquidity. | High minimum trade size, limited to accredited investors |

Below platforms are widely used OTC desk for crypto.

Binance’s Crypto OTC desk is exceptional in catering to everyday traders. Here is a general crypto OTC trading platform review:

| Platform | Advantages | Disadvantages |

| Binance’s OTC Trading Desk | High-volume trading without significant market impact Simple and efficient trading process Seamless integration with the main Binance platform A wide range of available cryptocurrencies Dedicated customer service | High minimum trade requirements (usually starting from 200k USD or equivalent), limiting its use for smaller traders Subject to varying regional regulations which may impose certain restrictions or additional requirements |

ItBit stands out as a renowned cryptocurrency exchange, known for its provision of crypto OTC trading services. This serves as an overall review of a distinguished crypto OTC trading platform.

| Platform | Advantages | Disadvantages |

| ItBit OTC Trading Desk | Agency block trading: Paxos does not trade against counter-parties, ensuring a fair trading environment. Competitive pricing: They request quotes from multiple participants and liquidity venues to get the best price. Supported assets: Trades can be made in various currencies including BTC, ETH, LTC, BCH, PAXG, XLM, AAVE, MATIC, UNI, LINK, and SOL. Fast settlement: Most trades settle on the same business day they were booked. | High minimum trade size: The minimum trade size for OTC requests is $100,000 USD, which might not be suitable for smaller traders. Fee: There is a fee of 10 basis points (0.1%) on the notional value of the trade. Limited accessibility: All orders and confirmations are done via email or Telegram, which might not be as convenient as an integrated platform. |

Genesis Trading is a top OTC trading platform that offers services for a wide range of cryptocurrencies, along with bespoke trade structures and tailored settlement procedures. It has become a major player in the OTC market and is often ranked among the top crypto OTC desks in terms of trading volume. Here is a general crypto OTC trading platform review:

| Platform | Advantages | Disadvantages |

| Genesis Trading | Wide Range of Cryptocurrencies: Genesis supports a broad array of digital assets, allowing for more diverse trading options. Regulatory Compliance: Genesis is a regulated Digital Currency Group company, operating under the oversight of the New York State Department of Financial Services (NYDFS). 24/7 Trading: Genesis offers around-the-clock trading, catering to the non-stop nature of the cryptocurrency market. Experienced Team: Genesis has been in operation since 2013, offering significant experience in the space. Liquidity: As one of the largest OTC trading desks, Genesis offers high liquidity. | High Minimum Trade Size: Similar to other OTC desks, Genesis has a high minimum trade size, which might limit its accessibility for smaller traders. Limited Interface: As of my last update, Genesis primarily conducts trades through direct communication such as phone or email, which might not be as convenient as an integrated platform. Geographical Restrictions: Due to regulatory reasons, Genesis’ services may not be available in certain regions. |

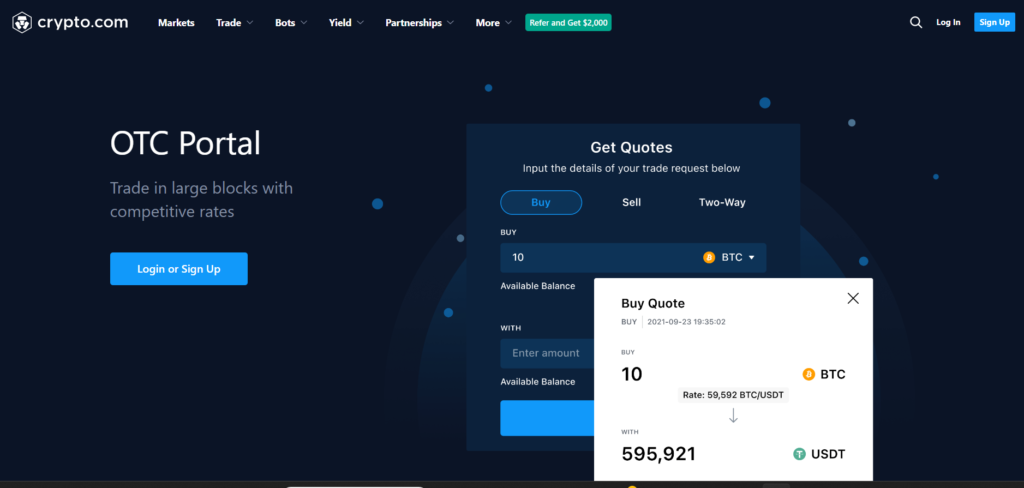

Crypto.com is a crypto exchange and financial services platform that allows users to buy, sell, and trade various cryptocurrencies. Crypto.com also offers OTC desk, below is a general review:

| Platform | Advantages | Disadvantages |

| Crypto.com OTC Desk | 24/7 Service: The OTC Trading Service is available 24/7, allowing constant access to transacted funds. Integration with Crypto.com: The OTC desk is fully integrated with the Crypto.com platform, making it easy to manage accounts and trades. No Additional Fees: There are no extra fees for obtaining a quote. Accessible Information: Users can easily view their Quote History and Trade History on the platform. Lower Minimum Trade Size: The minimum trading limit is 50,000 USDC for retail users and 100,000 USDC for institutional users | Limited to Selected Users: The service is available only to Crypto.com’s selected institutional and VIP users. Maximum Quote Limit: Users can only submit 1 quote request every 10 seconds, and there is a maximum quota limit of 5,000,000 USDC or its equivalent. Quote Expiry: The quote is valid for only 10 seconds. Regulatory Restrictions: Depending on regional regulations, certain users may not be able to access the OTC Trading Service. |

Kraken is a well-known cryptocurrency exchange with a dedicated crypto OTC desk for high-volume traders seeking personalized service and more liquidity. Here is a general crypto OTC trading platform review:

| Platform | Advantages | Disadvantages |

| Kraken | Broad Range of Cryptocurrencies: Kraken supports a wide variety of digital assets, providing more trading options. Competitive Pricing: Kraken OTC offers competitive pricing for trades. Personalized Service: Kraken OTC provides one-on-one service with a dedicated account manager to assist with trading and settlement. Integration with Kraken Platform: Kraken’s OTC desk is integrated with their regular exchange platform, allowing for seamless transfers between accounts. Strong Reputation: Kraken is known for its security and regulatory compliance, making it a trustworthy platform. | High Minimum Trade Size: Similar to many OTC desks, Kraken has a high minimum trade size (around $100,000 or equivalent), which might limit its accessibility for smaller traders. Potential Geographic Restrictions: Depending on regulatory environments, Kraken’s services may not be available in certain regions. |

Risks of Crypto OTC Trading

Crypto OTC trading has upsides but also downsides and risks. These include:

- Counterparty Risk: This is the chance that the other person in the trade doesn’t do what they promised. You should check their trustworthiness before trading.

- Lack of Liquidity: Since OTC trades aren’t public, finding someone to trade with can be hard, especially for less popular or smaller cryptocurrencies.

- Lack of Transparency: OTC trades aren’t public, making it hard to follow market trends and prices, and ensuring fair pricing can be tough. This lack of openness could lead to fraud or unfair transactions.

- Regulatory Risks: Crypto rules are changing fast, creating uncertainty and making it harder to follow the rules.

Check out The Best Crypto Options Trading Platforms of 2023!

Conclusion

While crypto OTC trading can offer several benefits, including greater privacy and customization, it is not without its risks, including counterparty risk, lack of liquidity, and regulatory risks. Before going into an OTC deal, it is vital to weigh the potential benefits, risks and evaluate the financial stability and creditworthiness of the counterparty. Doing your own research and due diligence can help you make wise investment decisions.

Frequently Asked Questions (FAQ)

Can I buy crypto OTC?

Yes, you can definitely buy crypto OTC or over-the-counter trade. Crypto OTC trading is a service that allows you to trade large amounts of cryptocurrencies instantaneously with another party, commonly without going through an exchange orderbook. It is often used by institutional investors, high-volume traders, or those who want to carry out large trades without causing huge price movements in the market

To buy crypto OTC, you can follow these general steps or depending on the platform:

1.Find an OTC trading platform

2.Complete KYC/AML process

3.Request a quote

4.Confirm the trade

5.Store your cryptocurrency

Bear in mind that OTC trading is more fit for large-scale trades, and it may not be the best option for small or retail investors.

Can I trade OTC on Binance?

Yes, you can trade OTC on Binance thru their OTC portal. Binance offers crypto OTC trading to user from low to large trades.

Is crypto OTC trading platform legit?

Yes, crypto OTC trading platforms can be legitimate. However, like any financial service, the legitimacy can vary from platform to platform. Always conduct thorough research and due diligence before using any crypto OTC trading platform to ensure it is reputable and complies with necessary regulations.

Is Binance futures OTC?

No, Binance future is a crypto derivatives that allows users to trade futures contracts on different crypto with leverage.

What is OTC vs P2P crypto?

OTC (Over-the-Counter) and P2P (Peer-to-Peer) crypto trading both facilitate trades outside conventional exchanges. Crypto OTC trading involves private, large volume transactions typically executed through a broker or trading desk, offering more privacy and minimal price impact. P2P trading connects individuals directly, catering to retail investors with smaller trade volumes and more flexible payment options, but may require more trust between parties. The choice between the two depends on factors like trade size, privacy concerns, payment methods, and trust in the counterparties.

Is OTC trading better?

Whether OTC trading is better for you depends on factors like trade size, privacy concerns, price impact, and the level of personalized service you require. It’s essential to evaluate these factors and determine if OTC trading aligns with your trading goals and risk tolerance.

How Do OTC Desks Make Money?

OTC desks make money through bid-ask spreads, fees, market making, arbitrage, block trading, and access to exclusive deals. Their primary goal is to facilitate large transactions for clients while minimizing price slippage and ensuring smooth execution.

What is the difference between OTC trading & Exchange Trading?

OTC trading occurs directly between parties, often less regulated, and offers more customization. Exchange trading occurs via a central exchange and tends to have more regulation and transparency but less flexibility.

How do you trade on OTC?

OTC trading requires an account with a broker that offers OTC services. Once funded, you can begin trading OTC securities.

None of the content above is financial advise and is for educational purposes only. Find more content on algorithmic trading software, crypto market making and market microstructure on Autowhale’s blog.