In recent years, cryptocurrencies have seen a rapid rise in popularity. Many people are investing in well-known cryptocurrencies such as Bitcoin and Ethereum, as well as in relatively new cryptocurrencies such as Cardano (ADA), Polygon (MATIC), and FLOKI.

Some people choose to hold their assets in the hope that the value will rise in the future; this is known as “HODLing.” Others are searching for ways to profit and earn from their investments more quickly or efficiently.

Crypto asset management plays an important role in maximizing the return on your investment. In this blog, we will discuss crypto asset management and explore a few organizations that can guide you in managing your cryptocurrency holdings.

What is Crypto Asset Management?

Crypto asset management is the process by which an investor or trader actively manages his or her crypto investments in order to get a higher return on investment than would be possible with passive investments or “buy and hold” strategies.

In its simplest interpretation, crypto asset management is like managing a collection of digital coins or money called “cryptocurrency. It involves making smart decisions about when to buy, store, or sell these coins in order to expand and profit from your collection or investment.

Just like with any other investment, it’s important to keep an eye on the trend and what’s happening in the crypto market so you can make the best decisions. Think of it like playing a game of Monopoly – you want to buy properties and collect coins when the time is right, and sell them at the right time so you can make a profit. Crypto asset management helps you do the same thing with your crypto investments.

Why is Crypto Asset Management Important?

The crypto world can be a crazy roller coaster ride, with market prices fluctuating day by day. It’s terrifying and can lead to a racing heart to see the sudden price changes, and at the same time, it’s exciting and thrilling.

As an investor, it can be really challenging to keep up with the market movement and make the best decisions. Unfortunately, many people have lost a lot of money in this market due to its unpredictable nature. Therefore, solid crypto asset management is crucial. If you have a good understanding of how to manage your assets, it can help you reduce or prevent losses and potentially even make profits.

To achieve your investment goals and thrive in the crypto industry, you need to have a solid grasp of the basics of crypto asset management. This means having the right plan, understanding different strategies, and managing risks.

You’ll also need to be familiar with some of the tools that traders and market makers use, like order types, charting tools, derivatives, market data, etc. Check out this blog for the best crypto tools in depth. When it comes to crypto asset management, having basic knowledge goes a long way.

By learning about the ins and outs of crypto trading, the way the crypto market functions, and current trends, you’ll be better equipped to make clear judgments and protect your investments.

Check out Crypto Listing on Exchanges 2023: The Essential Role of Market Maker

Factors to Effective Crypto Asset Management

Research and Understand the Market

First things first, you should investigate the crypto industry. Among the steps involved in learning about the various crypto assets and how the market works. In order to educate yourself about the cryptocurrency market, you may do so by reading relevant articles, news, and websites.

The introduction of new assets, significant collaborations, regulatory changes, or the collapse of big institutions are all examples of market-moving events that should be monitored closely. Twitter and other social media platforms provide excellent opportunities to stay on top of breaking news and network with like-minded individuals.

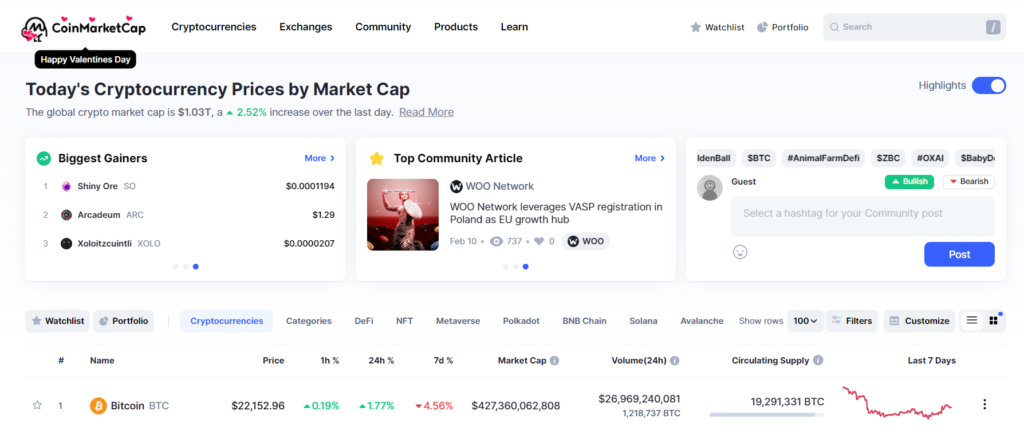

If you want to understand more about cryptocurrency, exchanges, and the market, Coinmarketcap is a great place to start. It reveals crucial data including supply and demand in the market, as well as price and volume. Cryptocompare is another helpful resource that gives you access to accurate market statistics and information for research purposes.

Create a Portfolio

Once you have a strong understanding of the market, the next step is to create a portfolio. This involves selecting the exchange platform on which you would start to build your portfolio and choosing a selection of different crypto assets to invest in based on your personal investment goals and risk tolerance. Binance is an example of a crypto exchange platform to buy, sell, and store assets. Binance is known for its beginner-friendly interface, which makes it a good place to start.

It is important to note that diversifying your portfolio can help reduce potential risk, rather than putting all of your eggs in one basket. To ensure a balanced portfolio, you should focus on both well-established coins like BTC and ETH, as well as smaller or up-and-coming tokens in the space.

Additionally, it is beneficial to maintain a low-cost investing portfolio, as this ensures that you remain in control of the investment. Especially for a beginner in crypto, always remember not to get carried away by the trend. Keeping your portfolio diversified can also help lower any potential risks associated with unexpected market changes.

Monitor and Adjust Your Portfolio

It is crucial to keep an eye on your portfolio and make modifications as required once you’ve set it up. The best way to make informed buying and selling choices in the ever-changing cryptocurrency market is to maintain your own records of the asset’s performance.

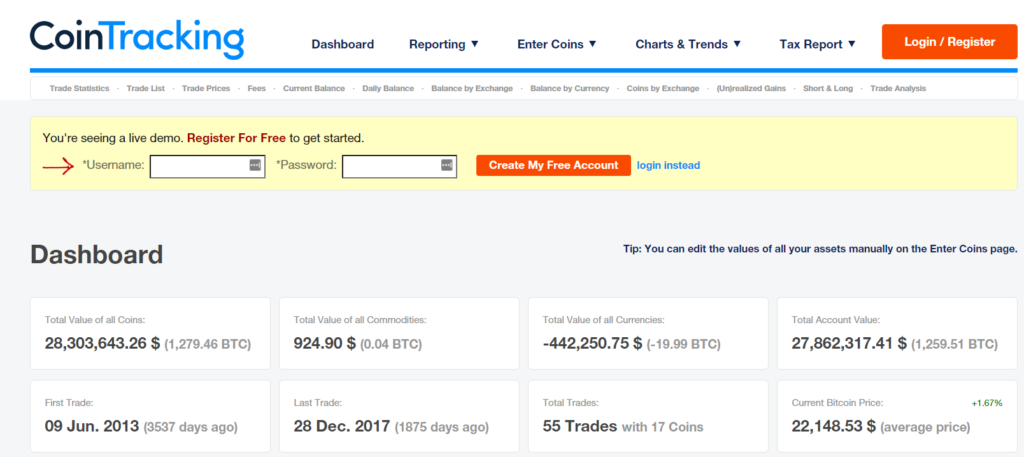

Many platforms are available that can help you with monitoring your portfolio, for instance, CoinTracking can analyze your trades and provide you instantaneous information on your wins and losses, coin value, and realized and unrealized gains.

Trading methods, such as purchasing and selling at predetermined thresholds or on certain dates, may also be useful in optimizing portfolio performance and minimizing risk exposure.

Use Tools and Resources

For the purpose of crypto asset management, a variety of tools and resources are available. These include online platforms, applications, and calculators that may be used to maintain portfolios, research various assets, and compare wallets and exchanges.

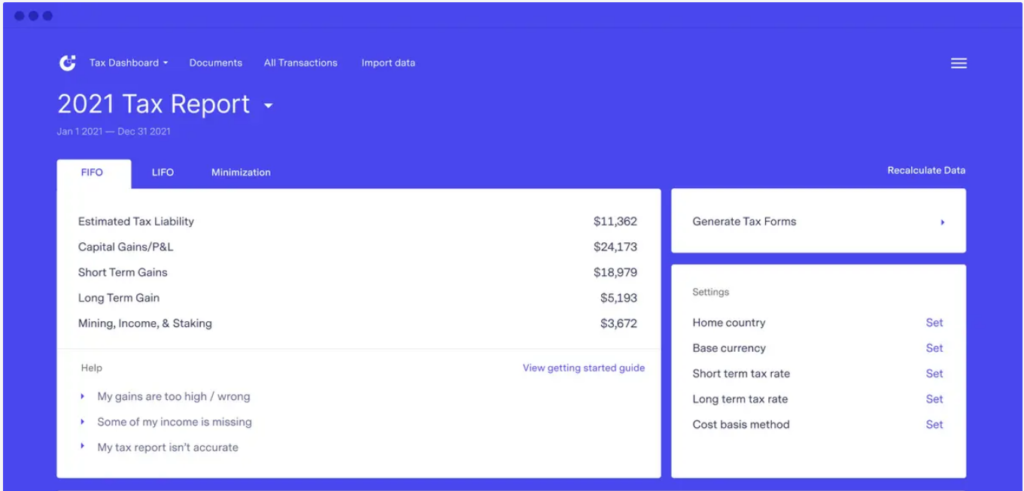

Some examples for tools for research are CoinMarketCap, which displays a variety of data on coin, tokens, and exchanges, as well as analytics and price comparison tools such as CryptoCompare, taxation tools like CoinTracker and TokenTax, and secure, self-storage cryptocurrency hardware wallets such as Ledger and Trezor are a few examples of the types of tools that fall into this category.

Always do your own research and due diligence to determine which one caters best to your needs.

Seek Professional Help

Managing your cryptocurrency assets can be difficult, especially if you are new to the market. Professional help is beneficial if you want to make smart investment decisions and improve your chances of success.

Working with a professional financial advisor or service that helps you manage your crypto assets can be an advantage. These experts can help you do things like keep track of your portfolio, research different crypto assets, and look at market trends to find opportunities and risks. But it’s important to do your own research before hiring a professional and make sure they have the right credentials, experience, and skills.

These are a few examples of financial advisory firms that provide crypto asset management services; Grayscale Investments, Bitwise Asset Management, and VanEck.

Conclusion

Ultimately, crypto asset management is a crucial part of crypto market investment. Investors can boost and expand their potential portfolio growth with in depth knowledge of crypto asset management. You may take advantage of valuable tools and resources, like portfolio tracking, investing analytics, and institutional-grade custody solutions, if you are aware of which crypto asset management platforms are best for your needs.

Using these platform services will keep you ahead of the game and closer to your goals. The crypto industry is growing and will continue to grow, it is important to stay up to date on the most recent trends, cycles and fads, news and developments, and to seek out the best tools and knowledge to help you realize your investing objectives.

None of the content above is financial advice and is for educational purposes only. Find more content on algorithmic trading software, crypto market making and market microstructure on Autowhale’s blog.